אמא הסמיכה את בנה לנהל חשבון בנק שלה.

לצורך ההסמכה חתמה על טופס ייפוי כוח בלתי חוזר נוטריוני לפי סעיף 91 לחוק לשכת עורכי הדין, תשכ"א-196.

ייפוי כוח זה הינו טופס הנמצא בשימוש עורכי דין רבים ויוצא לאור מטעם לשכת עורכי הדין. על פי לשון ייפוי כוח זה, הוסמך הבן (מיופה הכוח), על ידי אמו (החותמת על ייפוי הכוח), לעשות ב"גוש 30367 חלקה 39, המהווים מגרש במבשרת ציון" (להלן – "הנכס"), הרשום על שמה של האם, את כל הפעולות הבאות, או חלק מהן:

"למכור ולהעביר, להשכיר, להחכיר, [עד כאן הנוסח של הטופס המקורי, ולאחר מכן, בשורות שיש מקום, מודפסות מילים אלה]: למשכן, לשעבד, לרשום הערת אזהרה, להתקשר בחוזים, לטפל בכל הקשור בבניה על הרכוש המפורט להלן, לבקש רישיונות והיתר בנייה, לחתום על כל מסמך, לרבות קבלת משכנתאות, בכל עניין הנוגע לנכסים".

באמצעות ייפוי הכוח הנוטריוני האמור, נרשמה, ביום 26.6.97, משכנתא לטובתו של הבנק, להבטחת אשראי בעבור הבן, ללא הגבלה בסכום. בהתאם לכך, אישר הבנק לחברה א קבלת אשראי, בגובה של 800,000$.

מעט מאוחר יותר נקלע הבן לחובות והבנק החל בהליכי מימוש של הנכס.

בתגובה להליכי המימוש הגישה האם בקשה לסעד הצהרתי לבית המשפט המחוזי בירושלים, בו היא מבקשת, כי בית המשפט יקבע כי הנכס האמור, חופשי מכל שיעבוד.

במסגרת בקשה זו, טענה האם, כי ייפוי הכוח הוצא ממנה במרמה, וכי כל מטרת ייפוי הכוח, כפי שהוסבר לה על ידי הנוטריון, עו"ד אלברטו שרם (להלן – "הנוטריון"), היתה לצורכי בנייה בלבד, ואין ייפוי הכוח מאפשר לשעבד את הנכס לבנק, לצורך הלוואה שאינה לצורכי בנייה. לטענת האם, הבנק פעל שלא בתום לב, וכן הפר חובותיו כלפי האם, על פי חוק הבנקאות ותקנותיו.

ביום 19.2.07, הגיש בעלה תביעה לסעד הצהרתי (ה"פ 6052/07), במסגרתה, מבקש הבעל מבית המשפט, פסק דין המצהיר, כי הבעל הינו בעלים של מחצית מרכושה של האם, מכוח הלכת השיתוף בין בני זוג, וכי המשכנתאות הרשומות על נכסה של האם, אינם חלים על חלקו של הבעל בנכס.

האם טענה כי בעקבות החלטה על הגדלת אחוזי הבנייה, החליטה האם להרוס את המבנה שעל הנכס, לחלק את הנכס לשניים, ולבנות על כל מגרש 4 יחידות דיור. לטענתה של האם, לצורך כך, נתנה האם לבן, ייפוי כוח נוטריוני אשר למרות כותרתו "ייפוי כוח בלתי חוזר", הינו ייפוי כוח "רגיל", דהיינו: חוזר, זאת מאחר שאין צד ג', אשר ייפוי הכוח ניתן כדי להבטיח את זכויותיו.

לטענתה של האם, הנוטריון הסביר לה כי ייפוי הכוח הינו עבור בנייה בלבד, ואף הוסיף תוספת לייפוי הכוח, ממנה ניתן ללמוד, כי ניתן למטרה זו. האם מציינת, כי לא הייתה חותמת על ייפוי הכוח, כמו שהוא, וכך גם לא על ייפוי כוח כללי.

אם טוענת, כי הבן עשה שימוש בייפוי הכוח, כדי למשכן את הנכס, ולקבל אשראי לצורך עסקיו, ללא קשר לקידום הבנייה על המגרש. לטענתה של האם, בהתאם ללשון ייפוי הכוח, רשאי היה הבן, בין היתר, "לטפל בכל הקשור בבנייה על הרכוש המפורט להלן, לבקש רישיונות והיתר בנייה…" (ראה: ציטוט הקטע המלא של ייפוי הכוח, בפסקה 4 לעיל). לשון זו, הייתה צריכה "להדליק", לטענת האם, "נורה אדומה" אצל פקידי הבנק, וכי היה עליהם לברר ישירות עם האם, האם מסכימה היא, למשכון הנכס, למטרותיו העסקיות של הבן. האם ציינה בפני בית המשפט המחוזי, כי ברור היה לבנה, שהאם לא תחתום על מסמכים, הממשכנים את הנכס, לטובת עסקי הבן. לטענת האם, הבן אף אמר למנהל הבנק, מר אבי קצב, כי האם לא תסכים לחתום על מסמכים אלו, ונאמר לו, לחתום בעצמו על פי ייפוי הכוח. לטענת האם, במעשיו ו/או מחדליו של הבנק, הפר הבנק את חובותיו כלפי האם, על פי חוק הבנקאות ותקנותיו, וכן פעל שלא בתום לב.

לפי גרסת האם, בהתאם לסעיף 6(ב) לחוק השליחות, תשכ"ה-1965 (להלן – "חוק השליחות"), מאחר והפעולה בוצעה ללא הרשאה, ומאחר והפעולה לא אושרה בדיעבד, על הבנק לראות בבן כבעל דברו, או לתבוע את הבן, בגין הנזק שנגרם לבנק.

האם מתארת, כי משנת 1997, האמינה כי בנה מטפל בעניין הבנייה. לטענת האם, רק בתאריך 25.2.04, נודע למבקשת כי הבן משכן את הנכס לטובת הבנק, וכי התמנה כונס נכסים למכור את הנכס.

בתגובה, שלחה האם מכתב לבנק, שבו כתבה כי הפעולה בוצעה ללא הרשאה, וכי ייפוי הכוח בטל ומבוטל.

לטענת הבנק, מדובר בבנה של האם, אשר הוא מיופה כוחה לפעול בקשר נכס. הבנק מתנגד לביטול המשכנתאות, שנרשמו לטובתו של הבנק, זאת, מאחר שהם נערכו בהסתמך על ייפוי כוח נוטריוני בלתי חוזר ובלתי מסויג, ורשאי היה הבנק להסתמך עליו.

לפי גירסתו של הבנק, לאור בקשת חברה א, שבשליטת הבן, לקבלת אשראי בנקאי, נדרש הבן להמציא בטוחות לאשראי, והוא, בתגובה, הציע לשעבד לבנק, כביטחון, את הנכס.

לטענת הבנק, ביום 26.6.97, נתקבל אישורו של מנהל האזור, להעמדת האשראי, בכפוף למתן בטוחות. לטענתו של הבנק, כפי שעולה מאישור הנוטריון, עוד באותו יום, חתמה האם, אצל הנוטריון, על ייפוי כוח בלתי חוזר, המייפה את כוחו של הבן, לפעול על פי ההרשאות, וביניהם, למשכן את הנכס.

ממשיך הבנק וטוען, כי עוד באותו היום, התייצב הבן בסניף הבנק, הציג את ייפוי הכוח, המסמיכו למשכן את זכותה של האם בנכס, ומכוח ייפוי כוח זה, מושכן הנכס, לטובתו של הבנק, במשכנתא ראשונה בסכום בלתי מוגבל.

ייפוי הכוח, אשר מכוחו נחתמו המשכנתאות האמורות, הינו, לטענת הבנק, בעל נוסח רחב, ולשונו מתירה במפורש גם מישכון. לטענת הבנק, מדובר בייפוי כוח בלתי חוזר, סטנדרטי, המסמיך את הבן לנהוג כמנהג בעלים, ומכוחו של ייפוי הכוח האמור מוסמך הבן למכור, להעביר, להשכיר ולהחכיר את הנכס.

הבנק מציין, כי על גביו של ייפוי הכוח, הוספו הוספות מודפסות במכונת כתיבה (מעבר לנוסח הסטנדרטי של הטופס, הכולל הסמכה "למכור ולהעביר, להשכיר, להחכיר"), לפיהן, הוסמך הבן מפורשות לעשות את הדברים הבאים:

"למשכן, לשעבד, לרשום הערת אזהרה, להתקשר בחוזים, לטפל בכל הקשור בבניה על הרכוש המפורט להלן, לבקש רישיונות והיתר בנייה, לחתום על כל מסמך, לרבות קבלת משכנתאות, בכל עניין הנוגע לנכסים".

לטענת הבנק, מהנוסח אשר הוסף במיוחד, ניתן ללמוד שהבן הוסמך, במפורש, גם למשכן את הנכס.

מלשון ייפוי הכוח, עולה, לטענת הבנק, באופן ברור, בלתי מסויג וחד-משמעי, כי האם מסמיכה את הבן, למשכן את הנכס. לטענתו של הבנק, טענת האם, בדבר חריגה של הבנק מהרשאה, היא טענה בעל פה, כנגד מסמך, ולכן יש לדחות את טענת האם, בדבר חריגה מהרשאה.

מאחר שעל פי לשון ייפוי הכוח, יכול היה הבן אף למכור את הנכס, אין, לטענת הבנק, לקבל את גרסת האם, כי ייפוי הכוח נועד רק לשם ביצוע פעולות הקשורות בבנייה על הנכס.

לטענת הבנק, בהתאם לכללי הפרשנות, העובדה שהאם בחרה שלא לסייג את לשון ייפוי הכוח, פועלת לרעתה.

גם מועד עריכתו של ייפוי הכוח, מלמד, לטענת הבנק, כי ניתן לצורך עריכת המשכנתא, ולא לצורך הבניה; ראייה לכך, שעוד באותו יום בו ניתן האישור הסופי, של מנהל האזור, למתן האשראי, נערך ונחתם ייפוי הכוח בפני הנוטריון, ונחתם שטר המשכנתא, מכוח ייפוי הכוח האמור.

הבנק מציין, שטענת האם, כי ייפוי הכוח נועד לצורך בנייה, היא טענה בעל פה, כנגד מסמך בכתב, שלשונו ברורה, וזאת, בניגוד לאמור בסעיף 80 לחוק הפרוצדורה האזרחית העותומני. כלל זה, יפה, לטענת הבנק, במיוחד במקרה זה, בו מדובר בייפוי כוח נוטריוני, בלתי חוזר, אשר מעצם מהותו, נועד לשימוש ולהסתמכות על ידי צדדים שלישיים, שלא נכחו בעת עריכתו.

לטענת בא כוחו של הבנק, סעיף 19 לחוק הנוטריונים, תשל"ו-1976, קובע חזקה ראייתית, לנכונות האמור באישורו של נוטריון, אשר ניתן לפי החוק; לפיכך, הוא מדבר בעד עצמו. בכל מקרה, חזקה על הנוטריון שהסביר למבקשת את מהות חתימתה על ייפוי הכוח.

לתמיכה בטענתו, כי לא הייתה חריגה מהרשאה, מציין הבנק את העובדה שהאם לא צירפה כמשיבים להמרצת הפתיחה, לא את הבן, ולא את הנוטריון, אשר ערך את ייפוי הכוח, ואימת את חתימת האם עליו.

הבנק מכחיש את טענת האם, כי הבן אמר לבנק, שהאם לא תסכים לחתום ערבות עבור עסקיו של הבן (ראה לעיל פיסקה 24). לעניין זה, מפנה הבנק, לתצהירו של מר אבי קצב, מנהל סניף הבנק.

הבנק דוחה את טענות האם, בדבר הדירותו של ייפוי הכוח. לטענת הבנק, כפי שנרשם בכותרתו, ייפוי הכוח הינו בלתי חוזר; לפיכך, כל טענה כי ייפוי הכוח הוא הדיר, היא טענה בעל פה, כנגד מסמך בכתב. הבנק מציין, כי בניגוד לטענת האם, אי קיומו של צד ג', אינו מהווה עילה לפסילת ייפוי הכוח הבלתי חוזר.

לטענתו של הבנק, אף אם לא היה כתוב במפורש כי ייפוי הכוח הינו בלתי חוזר, מרגע שהסתמך הבנק על ייפוי הכוח, והעניק אשראי, בהסתמך על משכון שנרשם מכוח אותו ייפוי כוח, הפך ייפוי הכוח האמור, לייפוי כוח לטובת צד ג'. על כן, לפחות כלפי הבנק, ייפוי הכוח הינו בלתי הדיר.

בעניין זה, מוסיף הבנק, כי גם לולא היה מדובר בייפוי כוח בלתי חוזר, במקרה דנן, לא התקיים אף אחד מהמקרים המביאים לסיומה של השליחות, על פי סעיף 14(א) לחוק השליחות.

בסיום דבריו, טוען הבנק, כי בהתאם לעולה מטענותיו, המשכנתאות הרשומות לטובת הבנק, נרשמו כדין, ואין עילה לביטולן.

על כן, מבקש הבנק, מבית המשפט, לדחות את המרצת הפתיחה, ולחייב את האם, בהוצאות הבקשה ושכר טרחת עו"ד, בצירוף מע"מ כדין.

הבעל מבקש מבית המשפט זה, פסק הצהרתי, לפיו הבעל הינו בעלים של מחצית הזכויות בנכס, מכוח הלכת שיתוף הנכסים בין בני זוג.

עוד מבקש הבעל, כי בית המשפט יקבע, כי הבעל זכאי להירשם כבעלים, על מחצית מהזכויות בנכס, וכן כי המשכנתאות הרשומות על הנכס, אינן חלות על חלקו של הבעל בנכס, כל זאת, לטענת הבעל, בהתאם לפסק דין שניתן בבית המשפט לענייני משפחה בירושלים (ראה: נספח "ג" לתביעה למתן פסק דין הצהרתי בה"פ 6052/07 הנ"ל).

לבסוף, מבקש הבעל מבית המשפט, לחייב את הבנק בהוצאות ובשכר טרחת ב"כ הבעל, כל זאת בהנחה שהבנק יתנגד לבקשה.

נימוקי הבקשה של הבעל

54. הבעל מציין, באמצעות עו"ד לענייני משפחה כי הוא והאם נישאו בשנת 1951; על כן, חלה עליהם הלכת שיתוף נכסים, ולא חל עליהם חוק יחסי ממון בין בני זוג, תשל"ג-1973 (להלן – "חוק יחסי ממון"), אשר חל על בני זוג שנישאו החל מיום 1.1.1974, ואילך.

55. עוד מציין הבעל, כי האם ירשה את הנכס מאביה, בשנת 1977, או בסמוך לכך. לטענת הבעל, למרות שהנכס התקבל בירושה, מדובר בנכס שהצדדים ראו אותו והתייחסו אליו, כאל חלק מן הרכוש המשותף.

56. לטענת הבעל, הוא והאם הינם אנשים מבוגרים, שאין ביניהם רכוש נפרד, וכי השיתוף מחייב, במקרה זה, מתן פסק דין, כמבוקש.

57. להלן, תיאור השתלשלות העניינים, כפי שמסביר הבעל:

א. ביום 30.8.79, נרשם הנכס על שמה של האם.

ב. ביום 9.12.04, עתר הבעל לבית המשפט לענייני משפחה בירושלים, בבקשה להצהרה, כי הבעל הינו בעלים של מחצית מהזכויות בנכס, מכוח הלכת השיתוף.

ג. ביום 28.12.06, ניתן פסק דין על ידי בית המשפט לענייני משפחה (כב השופט שלמה אלבז), הקובע כי הבעל הינו הבעלים של מחצית מכל רכושה של האם, מכוח הלכת השיתוף. עוד קבע בית המשפט לענייני משפחה, כי "פסק דין זה הינו במישור היחסים הפנימיים של בני הזוג, והוא אינו מחייב צדדים שלישיים".

58. לטענת הבעל, בד בבד עם הגשת כתב התביעה לבית המשפט לענייני משפחה, גילה הבעל, כי האם מסרה לבן ייפוי כוח נוטריוני בלתי חוזר. לטענת הבעל, ייפוי כוח בלתי חוזר זה, ניתן ללא ידיעתו, לצורך השבחה ובנייה על הנכס בלבד, ואילו היה יודע כי אשתו מתכוונת לחתום על ייפוי הכוח האמור, בנוסח המאפשר שעבודו לצורך משכונו לזכות הבנק, כי אז, היה מתנגד לכך בכל תוקף.

59. לבעל התברר, לטענתו, כי הבן עשה שימוש בייפוי הכוח מול הבנק, כדי לקבל אשראי, והכל שלא לצרכי בניה, אשר למען זאת ניתן ייפוי הכוח.

60. לטענתו של הבעל, רק ביום 25.2.04, סיפר הבן למבקשת, כי משכן את הנכס לטובת הבנק, וכי מונה כונס נכסים למכור את הנכס. רק אז, נודע לבעל על שני השעבודים, המוטלים על הנכס, לטובת הבנק.

61. הבעל חוזר על הטענה, כי לא ידע על ייפוי הכוח, ולכן, לשיטתו, אין בסיס להחלת המשכנתא על זכויותיו של הבעל בנכס, ואין לשעבוד עליהם כל תוקף.

62. הבעל תומך בטענות האם כלפי הבנק, וטוען, כי הבנק מעולם לא הודיע למבקשת או לבעל, אודות השימוש שנעשה בייפוי הכוח. לטענת הבעל, בכל מקרה, בכל הנוגע לזכויותיו של הבעל בנכס, דין המשכנתאות להיבטל.

63. לטענת הבעל, מאחר שזכאי הוא למחצית מהזכויות בנכס, מכוח הלכת השיתוף, ולאור פסק דינו הנ"ל של בית המשפט לענייני משפחה, ומאחר והבעל לא ידע כי האם מסרה לבן את ייפוי הכוח האמור, ומאחר שהבנק לא בדק את זכויות הבעל בנכס, ולא יידע את הבעל על השימוש שנעשה בייפוי הכוח, מתבקש בית המשפט, להורות ולפסוק כי הבעל הינו הבעלים של מחצית הזכויות בדירה, וזאת מכוח חוק יחסי ממון וכי המשכנתאות שנרשמו על הנכס, אינן חלות על הנכס.

הצורך במוסד השליחות נובע מכך כי לפנינו "חברה מתפתחת ופתוחה, בעלת פעילות כלכלית עניפה. בחברה כזו, אין האדם יכול לספק את צרכיו או את צרכי זולתו על ידי פעילותו העצמית. עליו להיעזר באחרים, הן לשם ייצור מוצרים והן לשם הפצתם. מכאן הצורך הכלכלי בקיום מוסד השליחות. הגשמתו של צורך זה, אף היא ביטוי לאוטונומיה של הרצון הפרטי.

הפעם מכוון רצון זה להענקת כוח לאחר לפעול בשמו של מעניק הכוח או עבורו" (דבריו של פרופ' אהרן ברק, חוק השליחות (מהדורה שנייה, ירושלים, תשנ"ו-1996), כרך ראשון, סעיף 161, עמ' 309-310; וראה המשך הדיון בעניין זה, בפרק השלישי של הספר, הנושא את הכותרת: "תורת השליחות").

סעיף 1 לחוק השליחות קובע, כי "שליחות היא יפוי כוחו של שלוח לעשות בשמו או במקומו של שולח פעולה משפטית כלפי צד שלישי".

מהות השליחות, באה לידי ביטוי, באימרת חז"ל, המופיעה בתלמוד הבבלי, מסכת קידושין, דף מב, עמ' א (אימרה זו מופיעה בתלמוד הבבלי בעוד עשרה מקומות, וכן בתלמוד הירושלמי ובמדרשי הלכה. היא התקבלה הלכה למעשה ברמב"ם, הלכות אישות, פרק ג, הלכה טו, וכן בטור, חושן משפט, סימן קפב, ובשולחן ערוך, ברמ"א, שם, סעיף א; בספרות ההלכה, על פי פרוייקט השו"ת, מונח זה מופיע ב-540 מקורות): "שלוחו של אדם כמותו".

משם, הועתקה אימרה זו של המשפט העברי, לסעיף 2 לחוק השליחות, הקובע כי "שלוחו של אדם כמותו, ופעולת השלוח, לרבות ידיעתו וכוונתו, מחייבת ומזכה, לפי העניין, את השלוח" (ראה גם: ברק, שם, בסעיף 191, עמ' 355, הערה 16).

שליחות יכולה להיות בכתב או בעל פה; סעיף 3(א) לחוק השליחות קובע: "השליחות מוקנית בהרשאה, שבכתב או שבעל פה, מאת השולח לשלוח, או בהודעה עליה מאת השולח לצד השלישי, או על ידי התנהגות השולח כלפי אחד מהם".

שליחות בכתב נעשית בדרך של חתימת שולח על ייפוי כוח.

ייפוי כוח, הינו מכשיר משפטי המוסדר בחוק השליחות, ותפקידו לאפשר למיופה הכוח, לעשות בשמו של מייפה כוחו פעולה משפטית כלפי צד שלישי, בהתאם למוסכם בייפוי הכוח.

כדי שלצד השלישי יהיה ביטחון כי אכן מי שנמצא לפניו הוא המוסמך להתחייב בשם השולח, קובע סעיף 3(ב) לחוק השליחות, כי אם "נדרש אדם להיזקק לפעולת שלוח, רשאי הוא שלא להכיר בשליחות כל עוד לא הוצגה לפניו הרשאה בכתב ולא נמסר לו העתק ממנה".

יש להדגיש, כי המשמעות של השליחות היא, כי "כוחו של השלוח היא לבצע פעולה משפטית בשמו של אחר או במקומו" (ברק, שם, בסעיף 204, בעמ' 375).

פרופ' אהרן ברק מסביר, כי מטרת השליחות היא "להעניק זכויות וחובות במישרין לשולח, אשר קיומו וזהותו ידועים לצד השלישי. המבחן הוא אובייקטיבי. השאלה אינה מה חשב לעצמו השלוח אלא כיצד תפס את הפעולה הצד השלישי הסביר: האם הוא ראה או צריך היה לראות, בפעולתו המשפטית של השלוח, פעולה שכוונתה היא ליצור קשר משפטי ישיר בינו לבין השולח …

אם צודקים אנו בהנחתנו זו, כי אז יש לומר שהשלוח פועל 'בשמו' של השולח גם במקום שמבחינה סובייקטיבית של השלוח הוא פועל בשם עצמו, ובלבד שהבעת הרצון של השולח כלפי הצד השלישי יצרה אצל זה האחרון את המחשבה הסבירה כי השלוח פועל בשם השולח" (ברק, שם, בסעיף 205, בעמ' 376; וראה גם דברי פרופ' זאב צלטנר, המצוטטים שם, ליד הערה 98).

במילים אחרות, וביישום העקרונות הללו למקרה שלפנינו, נוכל לומר את הדברים הבאים: כדי שייפוי הכוח יוכל לחייב, מבחינה משפטית, על בית המשפט להשתכנע כי אכן ייפוי הכוח, נחתם על ידי האם מרצונה הטוב והחופשי, כמו כל מסמך משפטי אחר. ייפוי הכוח, כולל את הסכמת החותמת על ייפוי הכוח, דהיינו: האם, כי היא מסמיכה את בנה, לרשום את המשכנתאות על הנכס של האם; מנקודת מבטו של הצד השלישי, הוא הבנק, יש להוכיח כי אכן כך הבין הבנק את מהות ייפוי הכוח, והסכים למתן האשראי ולרישום המשכנתאות, בהנחה כי ייפוי הכוח מאפשר לבן לחתום בשם האם על כך שהנכס ישועבד לצורך הבטחת חובותיו של הבן וחברותיו, לבנק.

אם אכן כל זאת יוכח, כי אז, רישום המשכנתאות אכן היה הגשמת עקרון השליחות והייצוג, מכוח ייפוי הכוח האמור; ומכאן, התוצאה המשפטית תהיה, כי אותן משכנתאות שנרשמו מכוח ייפוי הכוח הן תקפות ומחייבות והבנק יוכל לפעול מכוחן לצורך מימוש הנכס, וכך להיפרע ולממש את הנכס כדי שהתמורה שתתקבל ממכירתו תוכל להוות את פירעון החובות של הבן ושל החברות שהפעיל.

כדי להתמודד עם השאלה, האם אכן הבינה האם על מה היא חותמת, הובא כעד – עוד בישיבת ההוכחות הראשונה בתחילת ההליכים בתיק זה, בשנת 2005 – הנוטריון, עו"ד אלברטו שרם, אשר אישר את חתימתה של האם ואימת אותה.

כדי להבין את משמעות ייפוי הכוח הנוטריוני והשלכותיו על טענת האם בדבר אי הבנת המסמך או טענתה כי חתמה על ייפוי הכוח לצורך הבנייה ולא לצורך המישכון, אתייחס קודם למהות ייפוי הכוח הנוטריוני, על פי הדין, ולאחר מכן, אדון בתוקף ייפוי הכוח בנסיבותיו המיוחדות של מקרה זה.

הבעת רצונו של השולח למנות את השלוח, נקבעת על פי מבחן אובייקטיבי, כאשר הקובע הוא הרצון הגלוי ולא הרצון הכמוס, כפי שמסביר פרופ' ברק (שם, סעיף 346, עמ' 544-545):

טופס ייפוי הכוח הנמצא בתיק, הוא ייפוי כוח לפי סעיף 91 לחוק לשכת עורכי הדין, תשכ"א-1961, אשר קובע לאמֹר:

"יפוי-כוח שניתן בישראל לעורך דין לפעול בתחום הפעולות שיש להן קשר לשירות המקצועי שנותן עורך דין ללקוח לרבות קבלת כספים ודברים אחרים בשביל לקוחו בענין כזה, שחתימת הלקוח עליו אושרה בכתב על ידי עורך הדין, אינו טעון אישור אחר, על אף האמור בכל דין".

בפועל, אומנם הטופס הוא טופס של עו"ד, אך בפועל, כפי שכבר הוסבר לא אחת לאורך פסק דין זה, מיופה הכוח אינו עו"ד – אלא הבן; כפי שנכתב בכותרת של ייפוי הכוח, הוא אינו רק לפי סעיף 91 לחוק לשכת עורכי הדין, אלא הוא גם "נוטריוני" (בנוסח המודפס הכותרת היא: "ייפוי כוח בלתי חוזר נוטריוני/לפי סעיף 91 לחוק לשכת עורכי הדין, תשכ"א-1961").

לעניין ייפוי הכוח הנוטריוני, מציין פרופ' ברק בספרו, כי אחת הדוגמאות לאותו דין מיוחד הדורש כתב ליצירת השליחות, הוא: "ייפוי כוח כללי לפי חוק הנוטריונים", והוא מפנה (שם, סעיף 354, עמ' 552-553), לסעיף 20(א) לחוק הנוטריונים, התשל"ו-1976 (להלן – "חוק הנוטריונים"), שזה לשונו:

"יפוי-כוח כללי ויפוי-כח לביצוע עסקאות במקרקעין הטעונות רישום במרשם המקרקעין, לא יהיו בני-תוקף אלא אם ערך אותם נוטריון או אימת את החתימות שעליהם, כאמור בחוק זה ובתקנות על פיו; הוראה זו אינה גורעת מסעיף 91 לחוק הלשכה".

פרופ' ברק מסביר את הוראת סעיף 20(א) לחוק הנוטריונים (שהובא בפיסקה הקודמת) וסעיף 91 לחוק לשכת עורכי הדין (שהובא בפיסקה 203) ומנתח אותם (ברק, שם, סעיף 354, עמ' 553-554). לענייננו, רלוונטי, קטע אחד, קטן מתוך דבריו, שבו הוא כותב כדלקמן (שם, בעמ' 553):

"דרישת הכתב ליפוי כוח כללי אינה קבועה במפורש. כל שנקבע בחוק הנוטריונים הוא כי יפוי הכוח צריך להיערך על ידי נוטריון. אם יפוי הכוח לא נערך על ידו, הוא צריך לאמת את החתימות שעליו. מכאן המסקנה כי הוא צריך להיות בכתב".

בהמשך, מתייחס פרופ' ברק להוראת חוק הנוטריונים, לפיה כאשר מדובר בייפוי כוח לבצע עסקאות במקרקעין, יש צורך באישור הנוטריון, ומסביר את הקשר בין הוראה זו לבין חוקי השליחות וחוקי המקרקעין, במילים אלה (ברק, שם, סעיף 355, עמ' 554):

"חוק הנוטריונים קובע כי יפוי כוח לביצוע עסקאות במקרקעין הטעונות רישום במרשם המקרקעין צריך להיערך על ידי נוטריון. אם יפוי הכוח עצמו נערך על ידי נוטריון, עליו לאמת את החתימות שעל יפוי הכוח. מה הוא יפוי כוח 'לביצוע עסקאות במקרקעין הטעונות רישום במרשם המקרקעין'? משהתעוררה השאלה, נפסק כי יפוי כוח זה אין עניינו הרשאה לעשות עסקה במקרקעין. עניינו של יפוי כוח זה הוא, 'יפוי כוח לשם ביצוע הרישום בלבד'. פירוש זה יוצר הרמוניה ושילוב בין חוק הנוטריונים מזה, לבין חוק השליחות וחוק המקרקעין מזה".

ייפוי כוח זה, אשר נחתם בפני נוטריון, נהנה מחזקת התקינות, מכוח סעיף 19 לחוק הנוטריונים,

ברם, גם אם אין הוראה מפורשת בחוק, בנוסח שנכלל בהצעה, הפסיקה נתנה משקל רב מאוד לאישור הנוטריוני, ולמצער, הפכה את נטל הראיות במובן זה, שמי שמבקש לסתור אישור נוטריוני, עליו עול הראיה.

במילים אחרות, האם, הטוענת כי חתמה על ייפוי הכוח הנוטריוני, מבלי להבין את תוכנו, מוטל עול הוכחה מוגבר, לסתירת החזקה שבעובדה, כי אדם יודע את תוכנו של מסמך עליו הוא חותם, בכלל, ואם הוא מסמך שנחתם בפני נוטריון, בפרט.

האם טוענת, כי ייפוי הכוח לא נבדק על ידי הבנק, סמוך לפני רישומן של שתי המשכנתאות.

טענות בעל פה כנגד מסמך

סעיף 80 סיפא לחוק הפרוצדורה האזרחית העותומני קובע כדלקמן:

"תביעות הנוגעות לכל מיני התחייבויות, הסכמים, שותפות, קבלנות או הלוואה, שמקובל ונהוג לקבוע במסמכים והעולות על אלף גרוש, צריכות להיות מוכחות במסמך. טענה הנטענת נגד מסמך הנוגע לענינים האמורים, אפילו אם איננה עולה על אלף גרוש, צריכה להיות מוכחת על-ידי מסמך או על-ידי הודאתו או פנקסו של הנטען".

חזקה זו, קובעת כי כדי לסתור הסכמים, שנהוג ומקובל לעשותם בכתב, יש צורך במסמך נוגד, או לחילופין "על-ידי הודאתו או פנקסו של הנטען", חלה גם על ייפוי כוח נוטריוני זה, אשר מטבע הדברים נהוג לעשותו במסמך (ראה גם את דברי השופט אליקים רובינשטיין בע"א 8837/05 נביל מרשוד נ' גוואד תאופיק אל שורטי [פורסם בנבו] (2009)).

לענייננו, האם לא עמדה בתנאים הנדרשים לסתירת לשונו של ייפוי כוח, הנהנה מהחזקה שבסעיף 80 לחוק הפרוצדורה העותומני.

מעבר לנדרש בית המשפט מציין כי גם אם יקבל את גרסת האם, לפיה היא הסתמכה על הבן, ואילו הבן מצידו, הונה והחתים אותה על ייפוי הכוח האמור, בתואנה שייפוי הכוח הוא אך רק לצורך בנייה על הנכס, וכן, אם אקבל את גירסת האם, כי הנוטריון מעל בתפקידו, ולא הסביר למבקשת על מה היא חותמת (טענה חסרת בסיס שאותה דחיתי לעיל מכל וכל), גם אז, לא היה בכך בכדי לפגוע בכשרות המשכנתאות.

בהנחה כי האם, אשר חתמה על ייפוי הכוח, עשתה זאת תוך הסתמכות עיוורת על הבן, וללא קבלת כל הסבר מהנוטריון, גם אז, מנועה האם מלהעלות כנגד הבנק את הטענה, שלא הבינה על מה היא חותמת, ובכך להעביר את האחריות של רשלנותה היא ורשלנותו של של הנוטריון (שכזכור קבעתי, כי לא היה רשלן; הרשלנות הנטענת מוזכרת כאן רק לצורך הטיעון המשפטי), אל שכמו של הבנק (ראה: פרשת בנק איגוד, בעמ' 171-174; ע"א 1873/92 המגן חברה לביטוח בע"מ נ' פנחס הספל (1995), פ"ד נו(6) 529; ע"א 6645/00 ערד נ' אבן (2002), פ"ד נו(5) 365, 375-376).

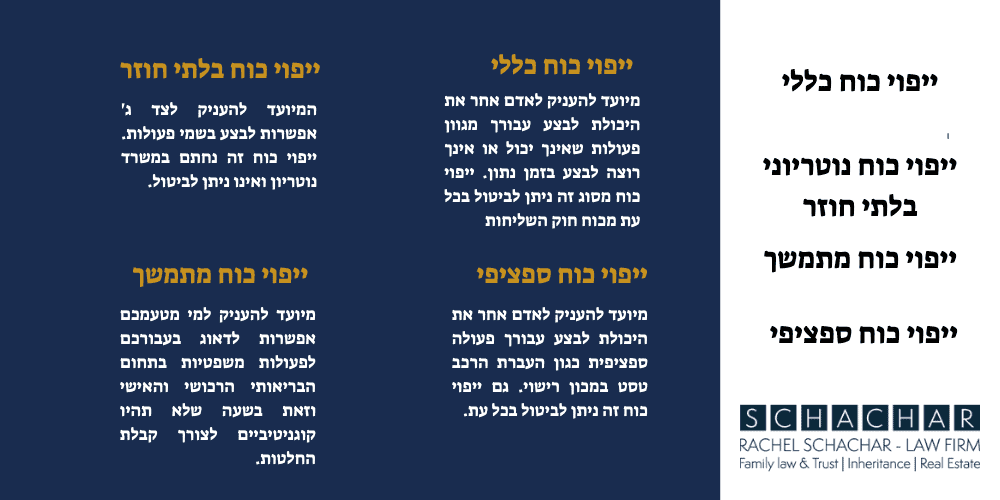

1. אני מקפידה להסביר כי למעשה ייפוי כוח נוטריוני בלתי חוזר נותן לבנק סמכויות אינסופיות במקרה של אי תשלום המשכנתא.

2. מובן שסמכויות אלה מופעלות על פי חוק אבל יש להבהיר כי ייפוי כוח נוטריוני בלתי חוזר הוא מכשיר משפטי חזק לאין שיעור ממכשירים משפטיים אחרים.

3. לא בכדי ייפוי כוח נוטריוני בלתי חוזר נחתם בפני נוטריון. אם יש לכם שאלות תשאלו את הנוטריון סעיף סעיף. לא תתקבל טענה שלכם בדיעבד שלא הבנתם.

4. אני ממליצה לקחת בחשבון שבפועל הבנק הוא שותף מלא שלכם לנכס עד לתשלום המשכנתא ולכן משכנתא הוא כלי חשוב אך גם בעל מרכיב של סיכון

עו"ד למשפחה לירושה צוואות ולענייני גירושין, עומדת בראש משרד עו"ד שחר הנחשב לאחד ממשרדי הבוטיק בצמרת משרדי עורכי הדין בישראל. המשרד שנוסד על ידה צמח והתפתח וכיום מעניק מגוון שירותים ובהם:

דיני משפחה וירושות, פשיטת רגל , הוצאה לפועל , איחוד תיקים, מחיקת חובות ועיכוב יציאה מהארץ.

המשרד משתף פעולה עם צוות יועצים חיצוניים בתחום הכלכלה והאקטואריה על מנת להעניק שירות של מעטפת מלאה.עו"ד רחל שחר, הנחשבת לאוטוריטה בתחום דיני משפחה וירושה ניהלה מאז הסמכתה מאות תיקים סבוכים בתחום דיני המשפחה והירושה תוך ניסיון ראשון במעלה להביא את הצדדים לפתרונות ללא הגעה לכתלי בית המשפט.